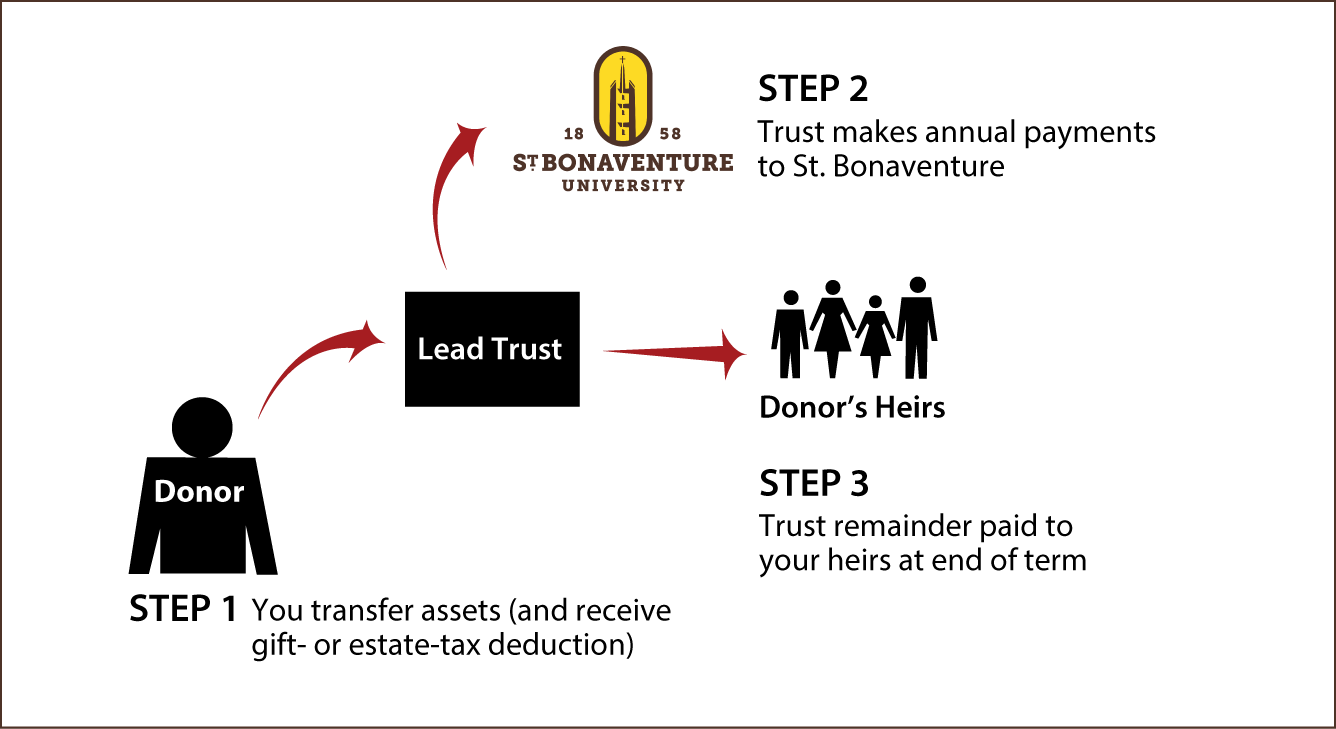

Nongrantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to St. Bonaventure

- Remainder transferred to your heirs

Benefits

- Annual gift to St. Bonaventure

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

Request an eBrochure

Request Calculation

Contact Us

|

Janet Glogouski |

St. Bonaventure University |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer